Commercial Real Estate Trends 2025Commercial Real Estate Trends 2025Commercial Real Estate Trends 2025

Meta Title: Commercial Real Estate Market Outlook 2025: Key Trends and Investment Strategies

Meta Description: Explore the 2025 commercial real estate market outlook, focusing on key trends like sustainability, technology integration, and investment strategies. Learn how these factors shape the future of CRE.

Focus Key Phrase: Commercial Real Estate Market Outlook 2025

Additional Unique Keywords: CRE trends 2025, sustainable real estate, smart buildings, hybrid office spaces, investment strategiesArizona Commercial Real Estate | ICREThe Business Achiever+1Oxford Companies+1

Introduction

The commercial real estate (CRE) sector is undergoing significant transformations as we approach 2025. Key factors such as sustainability, technological advancements, and evolving tenant preferences are reshaping the market landscape. Understanding these changes is crucial for investors, developers, and stakeholders aiming to navigate the future of CRE effectively.

1. Sustainability: A Driving Force in CRE

2. Technological Integration: Smart Buildings and PropTech

The integration of technology in commercial real estate is revolutionizing property management and tenant experiences. Smart buildings equipped with IoT sensors, AI-driven analytics, and automated systems are improving energy efficiency, security, and overall building performance. These technologies enable real-time monitoring of utilities, predictive maintenance, and personalized tenant services.Oxford Companies+1CCR Magazine+1The Business Achiever+1Oxford Companies+1

3. Hybrid Work Models and the Demand for Flexible Spaces

The rise of hybrid work models is influencing the design and utilization of commercial spaces. Companies are seeking flexible office layouts that accommodate both in-office and remote work arrangements. This shift is driving demand for coworking spaces and adaptable office environments that promote collaboration and productivity.The Business Achiever

Developers are responding by creating multifunctional spaces that can easily be reconfigured to meet changing tenant needs. This trend is particularly evident in urban centers, where businesses are looking to optimize space usage and reduce overhead costs.

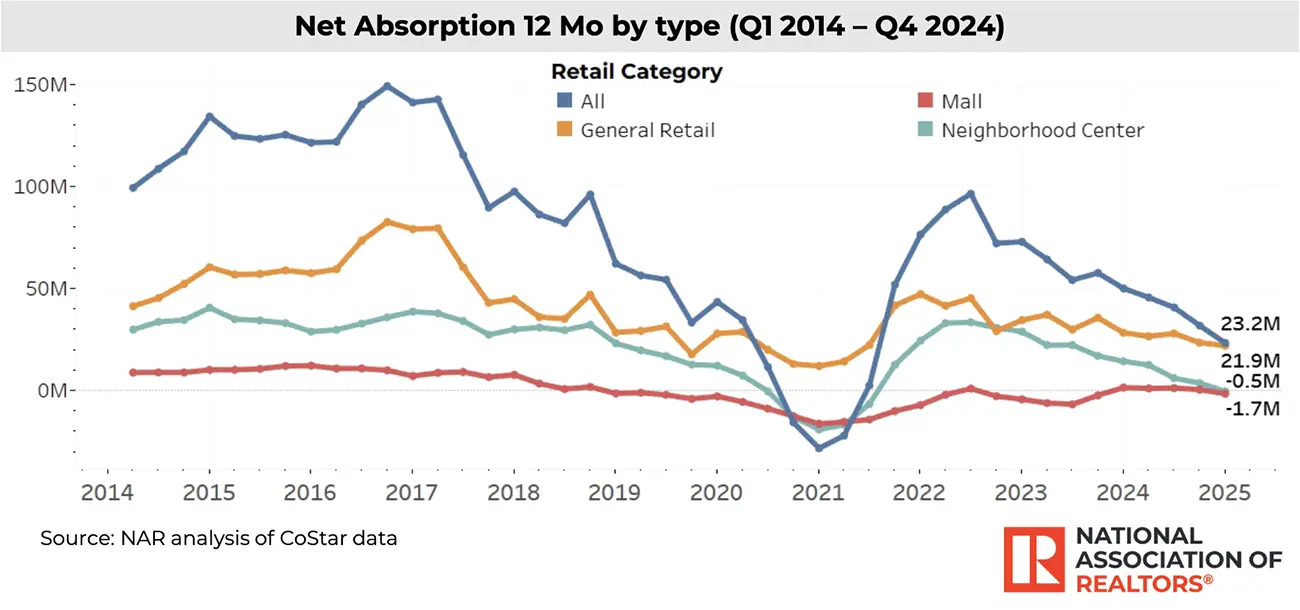

4. Mixed-Use Developments: Integrating Live, Work, and Play

Mixed-use developments are gaining popularity as they offer a blend of residential, commercial, and recreational spaces within a single project. These developments create vibrant communities where people can live, work, and enjoy leisure activities without the need for extensive commuting. Such integrated environments are attracting tenants who value convenience and a balanced lifestyle.

For investors, mixed-use properties provide diversified income streams and reduced risk. The combination of residential, retail, and office spaces ensures a steady demand across different market segments, enhancing the overall resilience of the investment.

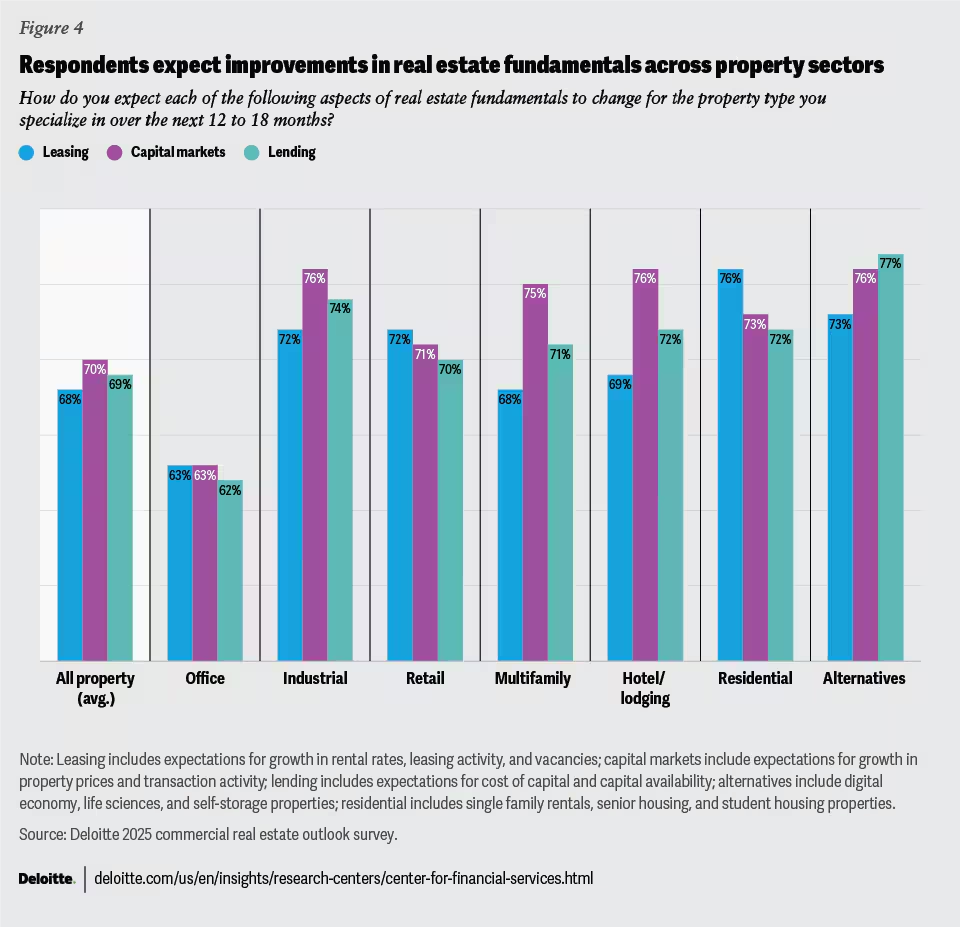

5. Investment Strategies: Navigating the Evolving Market

Investors looking to capitalize on the evolving commercial real estate market should consider the following strategies:

- Focus on Sustainable Properties: Investing in green buildings not only aligns with environmental goals but also offers financial benefits through reduced operating costs and higher tenant retention rates.GroundFloor

- Embrace Technological Advancements: Properties equipped with smart technologies are attracting tech-savvy tenants and achieving higher operational efficiency, making them attractive investment options.Oxford Companies+5Arizona Commercial Real Estate | ICRE+5The Business Achiever+5

- Explore Emerging Markets: Cities experiencing population growth and economic development present opportunities for investment in commercial real estate. These markets often offer higher returns and less competition compared to established markets.GroundFloor

- Diversify Portfolios: Incorporating a mix of property types, such as office, retail, and industrial, can mitigate risks and enhance returns.

6. Regulatory Considerations and Market Dynamics

Understanding local regulations and market dynamics is crucial for successful investment in commercial real estate. Changes in zoning laws, building codes, and tax policies can impact property values and rental yields. Staying informed about these factors allows investors to make proactive decisions and avoid potential pitfalls.

Additionally, market trends such as shifts in tenant preferences and economic conditions can influence demand for commercial spaces. Regularly assessing these trends helps investors identify opportunities and adjust their strategies accordingly.

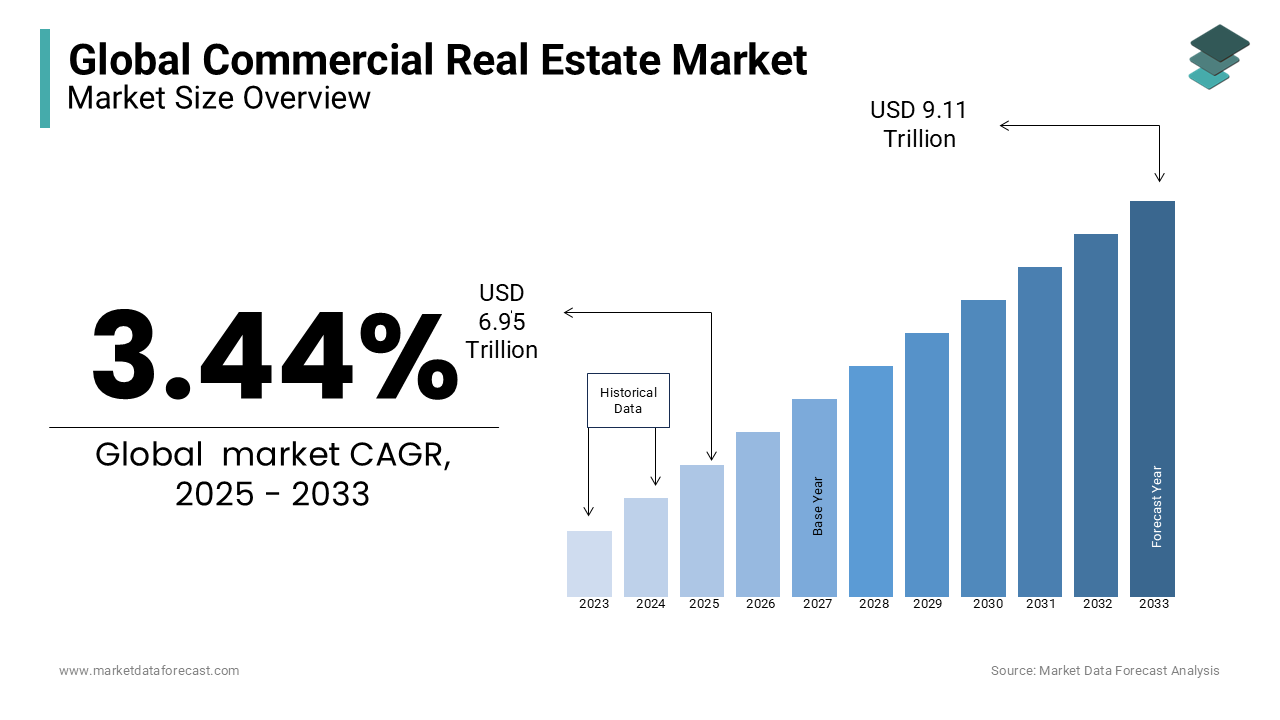

7. The Future Outlook: What to Expect in 2025 and Beyond

Looking ahead, the commercial real estate market is expected to continue evolving in response to technological advancements, sustainability initiatives, and changing tenant expectations. Properties that integrate smart technologies, prioritize sustainability, and offer flexible spaces will be well-positioned to attract tenants and investors.The Business Achiever+1GroundFloor+1

Moreover, the demand for mixed-use developments and the rise of hybrid work models will shape the design and functionality of commercial spaces. Investors who adapt to these trends and align their portfolios with market demands are likely to achieve long-term success in the commercial real estate sector.The Business Achiever

Conclusion

The commercial real estate market in 2025 presents a dynamic landscape filled with opportunities and challenges. By focusing on sustainability, embracing technological innovations, and understanding market trends, stakeholders can navigate this evolving sector effectively. Strategic investments and informed decision-making will be key to thriving in the future of commercial real estate.