Meta Title: Utah Real Estate Market Outlook 2025: Trends, Investment Strategies, and Regional Insights

Meta Description: Explore the Utah real estate market outlook for 2025, focusing on key trends, investment strategies, and regional insights. Learn about the factors shaping the market and opportunities for investors.

Focus Key Phrase: Utah Real Estate Market Outlook 2025

Additional Unique Keywords: Utah housing market trends, Utah real estate investment, Salt Lake City real estate, Provo housing market, Utah property investmentNick Booth Real Estate+1GTM Builders+1

Introduction

The Utah real estate market in 2025 presents a dynamic landscape influenced by population growth, economic development, and evolving buyer preferences. Understanding these factors is crucial for investors, homebuyers, and industry professionals aiming to navigate the market effectively.

1. Population Growth and Migration Patterns

Utah continues to experience significant population growth, attracting residents from states like California and New York. This influx is driven by the state’s robust job market, high quality of life, and relatively affordable housing compared to neighboring states. Areas such as Salt Lake City, Provo, and St. George are witnessing increased demand for housing, both for purchase and rent.Wolfnest+2Nick Booth Real Estate+2GTM Builders+2GTM Builders

2. Economic Factors Influencing the Market

Utah’s economy remains diverse and resilient, with key sectors including technology, healthcare, and education driving job creation. The “Silicon Slopes” region, encompassing cities like Lehi and Draper, continues to attract tech professionals, further fueling housing demand. Additionally, the state’s low unemployment rate and business-friendly environment contribute to a stable real estate market.GTM Builders+1Nick Booth Real Estate+1

3. Housing Inventory and Affordability

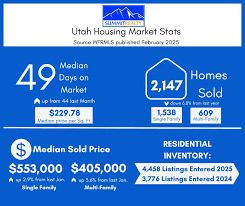

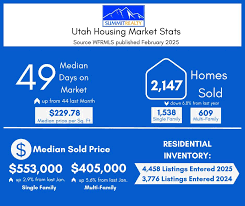

As of early 2025, Utah’s housing inventory has seen an uptick, with active listings increasing by approximately 23.7% compared to the previous year. This rise in inventory is attributed to stabilizing mortgage rates and a motivated pool of sellers. However, affordability remains a challenge, particularly in high-demand areas, as home prices continue to appreciate.KSL News

4. Regional Market Insights

Salt Lake City

Salt Lake City remains a central hub for real estate activity in Utah. The city’s urban revitalization efforts and growing demand for luxury housing have made it a hotspot for both young professionals and families. Neighborhoods like Rose Park and The Avenues are experiencing increased interest due to their proximity to downtown and unique character.GTM BuildersNick Booth Real Estate

Provo and Orem

The Provo-Orem area is attracting families and tech workers, thanks to its reputable schools and access to outdoor activities. The presence of Brigham Young University and the expansion of the tech sector contribute to strong rental demand and property appreciation in this region.Nick Booth Real Estate+2GTM Builders+2Utah Investor Hub+2Nick Booth Real Estate

Southern Utah

Southern Utah, particularly St. George, is gaining popularity among retirees and vacation home buyers. The region’s scenic beauty, warm climate, and proximity to national parks make it an appealing destination for those seeking a relaxed lifestyle.GTM Builders

5. Investment Opportunities

Single-Family Rentals

With a growing population and steady demand for housing, single-family rentals in Utah offer investors consistent cash flow potential. Cities like West Valley City and Eagle Mountain present opportunities for investors seeking affordable properties with strong appreciation prospects.Nick Booth Real Estate

Multi-Family Properties

Multi-family properties, such as duplexes and fourplexes, are in demand due to the need for affordable housing options. Investing in these properties can provide higher rental yields and diversification within an investment portfolio.

Commercial Real Estate

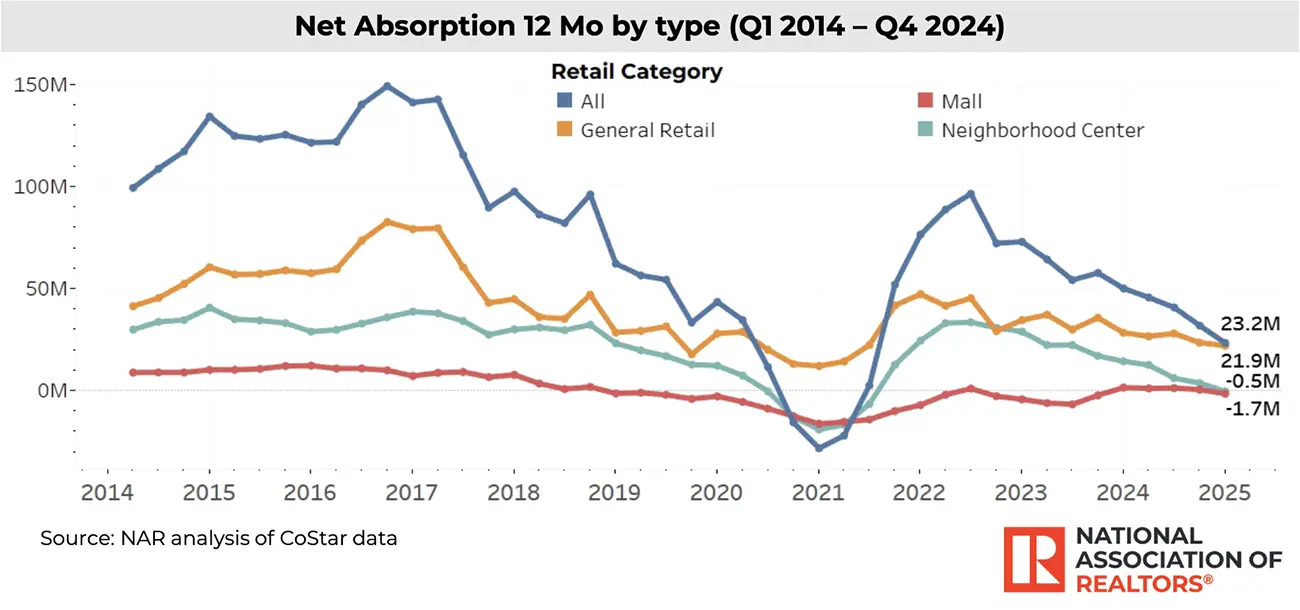

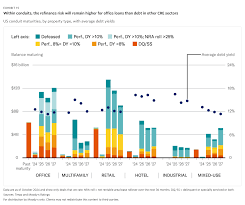

Utah’s expanding economy has led to increased demand for commercial real estate, including office spaces, retail centers, and industrial properties. Areas like Salt Lake City and Lehi are seeing growth in commercial developments, driven by the tech industry’s expansion and population growth.

6. Future Outlook

Looking ahead, Utah’s real estate market is expected to remain robust, supported by continued population growth, economic diversification, and infrastructure development. While challenges such as affordability persist, opportunities for investors and homebuyers exist across various regions and property types.

Conclusion

The Utah real estate market in 2025 offers a range of opportunities for investors and homebuyers. By understanding regional dynamics, economic factors, and emerging trends, stakeholders can make informed decisions to navigate the evolving market landscape.

External Links: