Introduction

The commercial real estate (CRE) sector in 2025 is undergoing significant transformations. Driven by technological advancements, shifting tenant expectations, and evolving economic conditions, the industry is adapting to meet new demands. This article delves into the key trends shaping the CRE market this year.

1. Rise of Hybrid Work Models

The hybrid work model has become a staple for many organizations. Companies are balancing remote and in-office work, leading to increased demand for flexible office spaces. These spaces offer adaptability, catering to varying team sizes and work styles. As a result, traditional office layouts are being reimagined to support collaboration and employee well-being.The Business Achiever+1Peak Commercial+1

2. Emphasis on Sustainability

Sustainability is no longer optional in CRE. Buildings with green certifications like LEED and WELL are attracting tenants and investors alike. Features such as energy-efficient systems, renewable energy sources, and water conservation measures are becoming standard. Investors are recognizing the long-term value of sustainable properties, which often yield higher returns.Private Capital Investors+1Peak Commercial+1The Business AchieverOxford Companies

3. Integration of Smart Technologies

The adoption of smart technologies is revolutionizing property management. IoT devices, AI analytics, and automated systems are enhancing building efficiency and tenant satisfaction. These technologies enable real-time monitoring of utilities, predictive maintenance, and optimized energy usage. As a result, properties are becoming more responsive to tenant needs and operational challenges.

4. Growth of Mixed-Use Developments

Mixed-use developments are gaining popularity, combining residential, commercial, and recreational spaces. These developments create vibrant communities where people can live, work, and play. They offer convenience and reduce the need for long commutes, aligning with the preferences of modern tenants. Investors are increasingly viewing mixed-use properties as resilient and profitable assets.

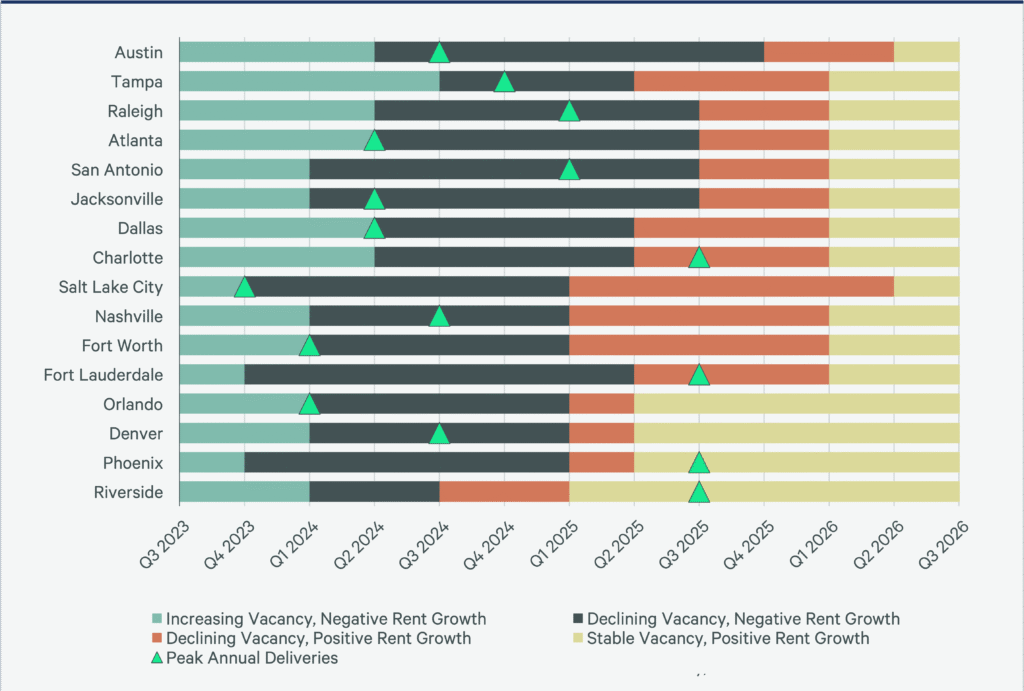

5. Demand for Prime Locations

Location remains a critical factor in CRE. Properties in prime locations continue to attract high-quality tenants and command premium rents. Urban centers and well-connected suburban areas are particularly sought after. Developers are focusing on these areas to capitalize on sustained demand and potential for appreciation.

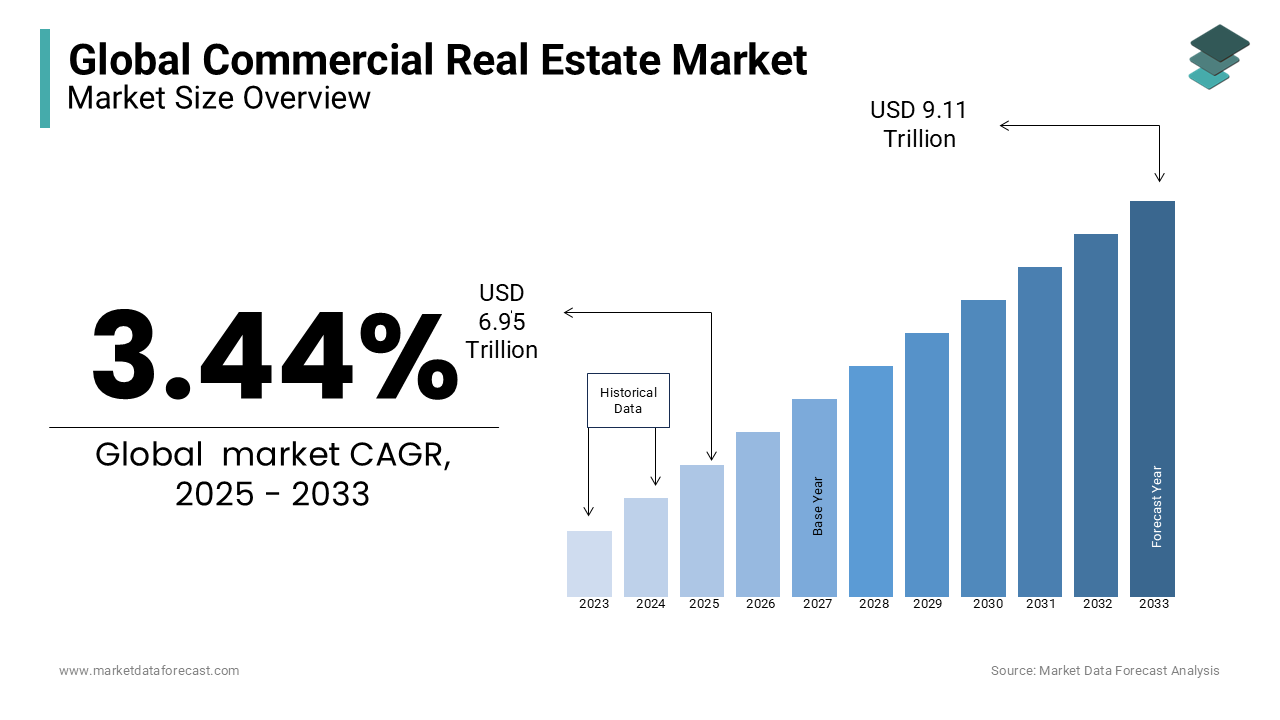

6. Impact of Economic Factors

Economic conditions play a significant role in shaping the CRE market. Interest rates, inflation, and economic growth influence investment decisions and property values. In 2025, economic uncertainties are prompting investors to be more cautious, focusing on properties with stable cash flows and long-term potential.

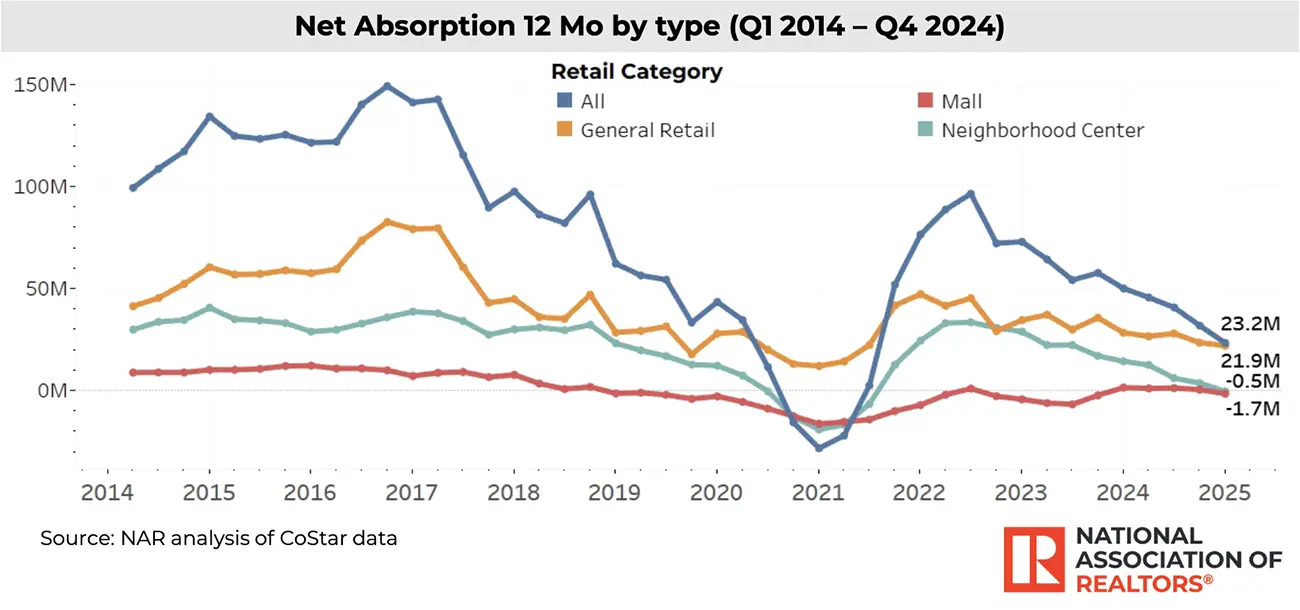

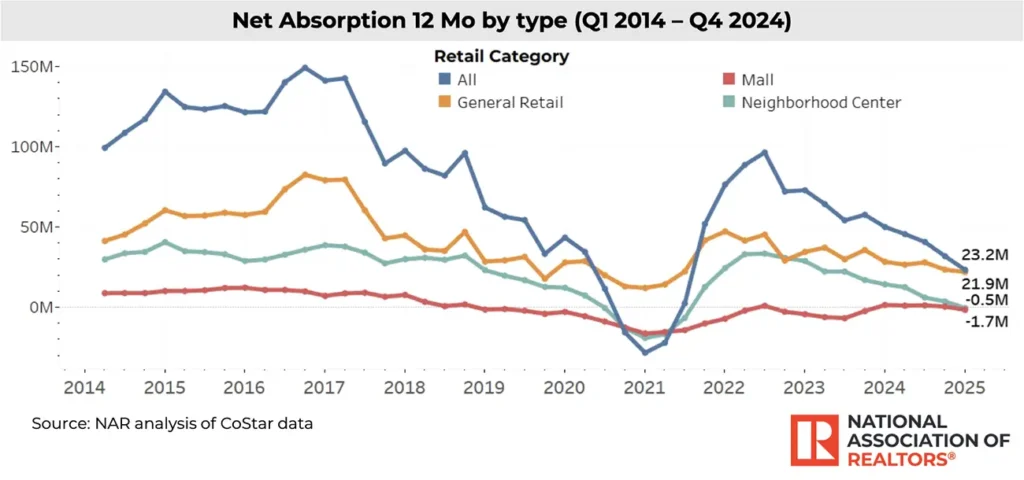

7. Evolution of Retail Spaces

The retail sector is adapting to changing consumer behaviors. E-commerce growth has led to a reevaluation of physical retail spaces. Retailers are seeking locations that offer experiential shopping experiences and integrate seamlessly with online platforms. As a result, retail spaces are being redesigned to enhance customer engagement and drive foot traffic.

8. Resilience in Industrial Real Estate

Industrial real estate continues to thrive, driven by the expansion of e-commerce and logistics. Warehouses and distribution centers are in high demand to support supply chain operations. Properties with advanced infrastructure and strategic locations are particularly attractive to investors seeking stable returns.

9. Focus on Tenant Experience

Tenant experience is becoming a key differentiator in CRE. Properties that offer amenities such as wellness facilities, high-speed internet, and flexible leasing options are more likely to attract and retain tenants. Landlords are investing in enhancing tenant satisfaction to reduce vacancies and increase occupancy rates.

10. Opportunities in Emerging Markets

Emerging markets present new opportunities for CRE investment. Rapid urbanization, growing middle-class populations, and improving infrastructure are driving demand for commercial properties in these regions. Investors are exploring markets in Asia-Pacific, Africa, and Latin America for potential high returns.

Conclusion

The commercial real estate landscape in 2025 is characterized by adaptability and innovation. Stakeholders who embrace these trends and remain responsive to market dynamics are well-positioned for success. By focusing on sustainability, technology, and tenant satisfaction, the CRE sector can navigate the challenges and opportunities of the evolving market.

Additional Unique Keywords:

- Hybrid Workspaces

- Green Building Certifications

- Smart Property Management

- Mixed-Use Developments

- Prime Real Estate Locations

- Economic Impact on CRE

- Retail Space Evolution

- Industrial Property Demand

- Tenant-Centric Amenities

- Emerging Market Investments

Unique Meta Tags:

<meta name="robots" content="index, follow"><meta name="author" content="CRE Insights"><meta name="publisher" content="CRE Insights"><meta name="viewport" content="width=device-width, initial-scale=1.0">

Meta Description:

Explore the top commercial real estate trends of 2025, including hybrid workspaces,sustainability, smart technologies, and emerging market opportunities .CCR Magazine+2The Business Achiever+2Peak Commercial+2

External Links: